Mastering the Basics of Bookkeeping Akfedfe

Mastering the basics of bookkeeping is crucial for both individuals and organizations aiming for financial stability. Double-entry accounting serves as the foundation, ensuring that every transaction is accurately reflected across multiple accounts. Ledgers play a significant role in maintaining organized records, while key financial statements offer insights into overall financial health. Understanding these components can lead to better financial management practices, but what specific techniques can enhance this understanding further?

Understanding Double-Entry Accounting

Double-entry accounting serves as the foundation of modern financial record-keeping, ensuring accuracy and accountability in financial statements.

This system relies on the duality of debit and credit entries, adhering to fundamental accounting principles. Each transaction impacts at least two accounts, fostering a balanced approach that enhances transparency.

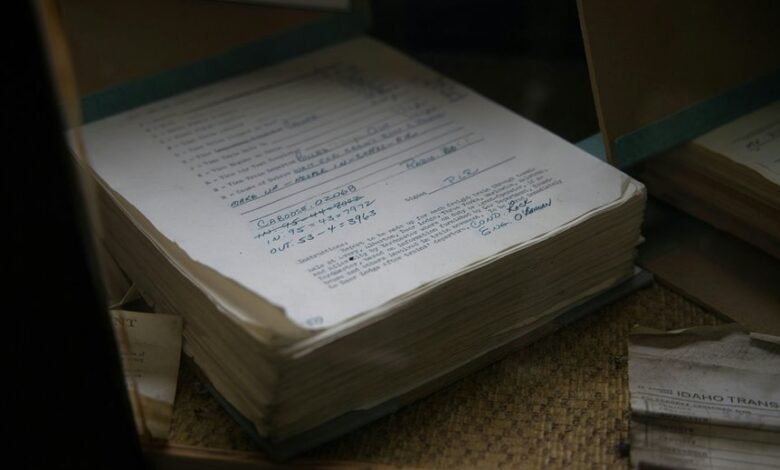

The Importance of Ledgers

Ledgers play a crucial role in the bookkeeping process, acting as comprehensive records that aggregate all financial transactions within an organization.

Effective ledger management is essential for maintaining accuracy and ensuring compliance.

Various ledger types, including general and subsidiary ledgers, provide detailed insights into financial health.

This structured approach facilitates informed decision-making, empowering organizations to achieve financial freedom and stability.

Key Financial Statements Explained

While financial health can often seem abstract, key financial statements serve as essential tools for organizations to translate complex data into actionable insights.

The balance sheet provides a snapshot of assets, liabilities, and equity, illustrating financial stability. In contrast, the income statement details revenues and expenses, revealing profitability over time.

Together, these documents empower stakeholders to make informed decisions regarding financial freedom and growth.

Tips for Effective Financial Management

Understanding key financial statements lays the groundwork for effective financial management.

Employing budgeting techniques ensures resources are allocated efficiently, while diligent expense tracking provides insights into spending habits.

By regularly reviewing these elements, individuals can identify trends, optimize financial decision-making, and achieve greater autonomy over their finances.

Ultimately, mastering these practices fosters a proactive approach to financial health and independence.

Conclusion

In conclusion, mastering the fundamentals of bookkeeping is crucial for anyone seeking financial literacy and stability. By grasping concepts such as double-entry accounting, leveraging ledgers, and interpreting key financial statements, individuals and businesses can significantly enhance their financial management capabilities. Ultimately, isn't it empowering to know that sound financial practices can lead to long-term stability and success? Embracing these principles paves the way for informed decision-making and greater financial autonomy in an ever-evolving economic landscape.